|

|

Miami, FL, August 7th, 2014

* Income Statement.

Before delving into the profit and loss statement, we will

explain a sale, which involves assets. Finally the company has

Item “abc” ready for sale. We will have a double sale

transaction, the first one, paid in cash by one customer and the

other one sold under credit terms to another customer. From the

initial inventory and the second acquisition, the total of

$700.00 invested on inventory gave us 100 “abc” items ready for

sale; this means that the cost of each item is $7.00. Our

original intention was to make 50% gross profit, therefore our

selling price per item will be $14.00

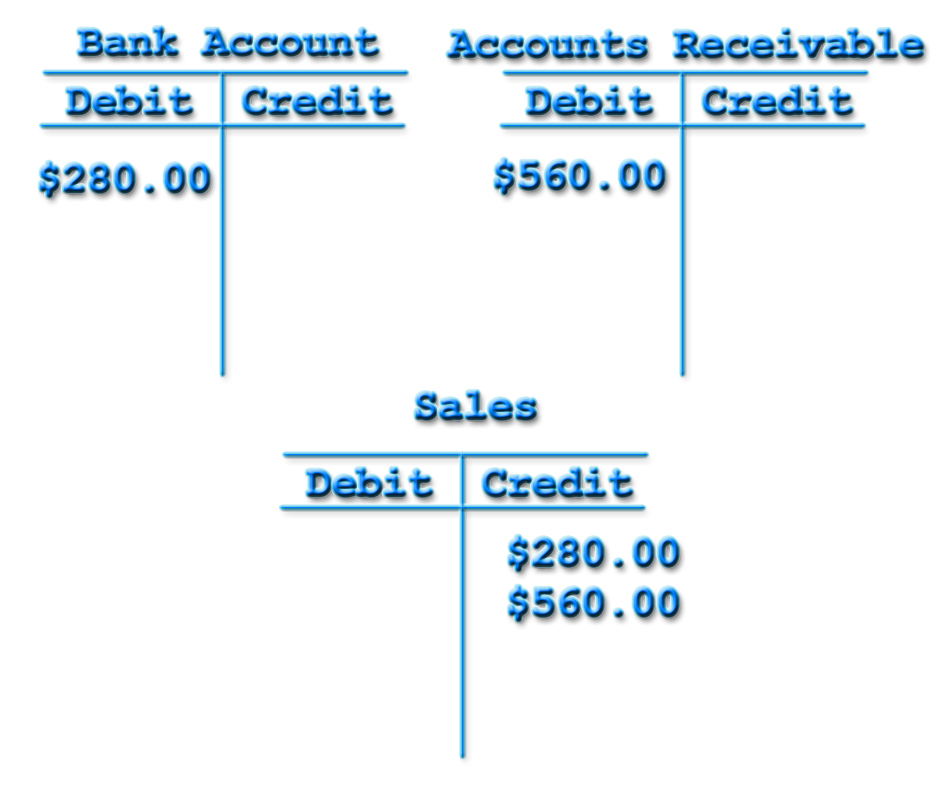

The first cash sale was for 20 items totaling $280.00 and the

second sales was for 40 items under credit terms for a total of

$560.00

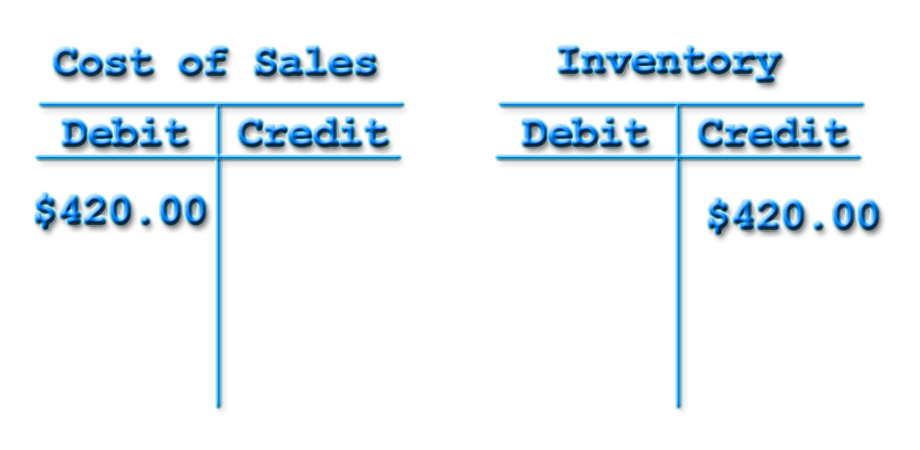

We need to register these two sales, but at the same time reduce

inventory, in order to do it we need to keep track of our sales

by item, so far we sold 60 and the cost per item was $7.00

totaling $420.00

This is how all transactions get registered on the company’s

books, step one sales:

Step two cost of sales and inventory.

|

* Fernando Angel

|

|

|

*

*

*

*

*

*

*

*

|

|

*

*

*

*

*

*

*

*

*

*

*

*

*

|

|